PLUS ULTRA CAPITAL PARTNERS

BEYOND EXPECTATIONS

The Plus Ultra Advantage: Tailored Investment, Targeted Growth

At Plus Ultra, we invest in companies with proven traction, aligning strategic capital through bespoke SPVs that simplify your cap table and enhance investor relations.

Our model ensures investors are all-in on your company, backed by a seasoned and vetted Go-To-Market operating team ready to accelerate your revenue and profitability growth.

With Plus Ultra, you get more than funding—you gain a dedicated partner committed to driving your success. Scroll down to discover how we can empower your vision.

Investment Thesis

At Plus Ultra, we target companies with revenue approaching $1M or more, where the signs of product-market fit are evident and the growth potential is substantial.

The things we need to see to invest: | |

Traction: | We invest in Growth, not ideas or prototypes. $1M or greater Revenue/ARR or a clear growth path to this within a quarter. |

Inflection Point: | We bring Capital AND GTM operating help to drive a measurable impact on growth trajectories. Transitioning from founder-led to sales-led growth, adding new GTMs, need to scale current GTMs, or new market entry |

Growth Potential: | Companies with big ideas, proven product-market fit, competitive differentiation, large TAMs, and understanding of GTM metrics |

SPV Fit: | Business models benefitting from "Smart Capital"; models with complex GTM models or technology stacks that don't fit well into average tech investor cookie-cutter mindsets |

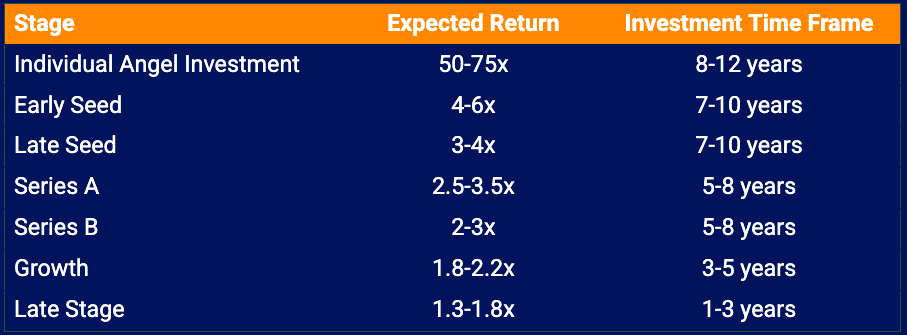

Check size: | Late Seed: $2-5M / Series A: $10-25M |

SPVs are our chosen investment vehicle because they align investors directly with the businesses they believe in, providing both flexibility and focus.

Our operational expertise truly sets us apart—our team collaborates closely with founders to optimize strategies, scale operations, and drive meaningful growth. We provide more than just capital; we deliver the strategic insights and hands-on support that drive long-term success.

About Us

At Plus Ultra Capital Partners, we bridge smart capital with go-to-market execution.

We invest in companies at key inflection points — backing founders who are ready to accelerate growth, not just raise capital.

Our Investment Focus

-

Companies with $1M+ revenue

-

Clear product-market fit

-

Focused on reaching scalable Series A growth

-

Strategically structured SPV deployment

Our Go-To-Market Expertise

-

Operators with CRO, CEO, CMO, and Sales VP experience

-

Expertise in revenue velocity, funnel building, and team scaling

-

Tactical execution, not theoretical advice

-

Aligned partnership with founders and leadership teams

We don’t just invest. We build alongside you.

Team

With a career spanning pre-revenue startups to senior leadership roles at Intel, IBM, and Nuance Communications (Microsoft), Pablo has a wealth of experience in leading sales and operational transformations, driving revenue growth, and executing complex go-to-market strategies. As a VC, Pablo's deal-making experience gives him a sharp eye for investment opportunities that offer growth potential and operational expertise to support founders in achieving profitable, efficient growth. He earned his MBA from Harvard Business School..

Rachel Corn is a seasoned the executive with significant growth and go to market experience. She has led growing technology companies as CEO and head of sales & marketing. Prior to her operational roles, Rachel led a diligence consulting and advisory firm, Topline Strategy, that worked closely with investors. Rachel is deeply familiar with what it takes to get funded and what is required to take a startup from zero to 100. She earned her MBA from Harvard Business School.